My Thoughts on Investment in Shares & SIP

My Thoughts on Investment in Shares & SIP

A.LIBIN ANTONY

Money is

the prime factor in human’s life . World is spinning towards one goal i.e.

Money. We used to hear the famous Tamil proverb called “ பணம் பத்தும் செய்யும்”

. This signifies that how important money is. Traditionally , we used to

save money through various schemes such as small savings , Recurring deposit

etc., People find these savings methods are much trustworthy because it can

bear very little profit and there is no damage for their capital. In this blog

I tell you in which mode of investment I made in Share market and whether it is

useful or not.

When I heard the word “SHARE

MARKET,SENSEX,NIFTY” Instantly I thought it’s a scam and share markets are only

meant for cheating. But when days passed, I came across the news of Warren

buffet and he is one of the billionaire of this era , he owns Berkshire

hathways and his company is a investment company and he makes money through Share

market, This stir me and break the

stereotype of Share market is Scam. I started studying what is share market and

how it works etc., and I got basic idea of Investments and Shares.

But the Problem with the Share market

is “Like all securities mutual funds are subject to market or systematic

risk. This is because it is difficult to predict what will happen in the future

or whether a given asset will increase or decrease in value. Because market

cannot be accurately predicted or completely controlled . I learnt that Fluctuation

price of stocks and shares on market based on the supply and demand policy.

Most common types of investments which I heard

is SIP, mutual funds, Growth stocks, Blue-chip stocks, bonds etc. Most people

see mutual funds are complicated and intimidating because in Television it

comes with a Disclaimer “ Mutual Fund investment are subject to market risk

,read all scheme related documents carefully” . So people might think this

is a trap so most of the peoples don’t want to take risk in their money.

Understand “ Where there is a high risk , there is a opportunity for high

growth”

I Choose Systematic Investment Plan(SIP) for Investing

. SIP is the investment method where you can invest the money in systematic

manner. You can start SIP from Rs.500 to Amount which you capable of

investing., In SIP We are investing in shares ., Markets are always volatile we

cannot predict the exact future of our

money. , So, Financial experts always

recommending that “ Go SIP with

Long term, it will bear us the expected profit” . If our investment period is

one or two years , we can see slight

growth of our money. Let me tell you the example of SIP. Assume that your

monthly SIP instalment is Rs.1000 and you are buying the share of an leading AMC , One AMC share cost RS.300 , so

you get 3.33 Shares in a month ., NAV of the share is not fixed it may

increase or decrease depending upon how market behaves, political factors etc.

Recently markets faced a sudden lag due to RUSSIA-UKRAINE Crisis., Ok, lets get

into the SIP Investment example , After one year AMC share is getting increased

to RS.500, at this time you can get 2 Shares in a month.,

Initially you buy a 3.33 Share with the amount of RS.300 for each

,now price of that share gets appreciated and you will be getting Profit

of Rs.200 for each share and in a

whole you are getting around the profit

of Rs.660. Above example shows you the positive side of the SIP

and remember that VICE-VERSA may happen for the

same. But , for a long term it is'a negligible factor and your capital

is assured and you may get get returns around 16-19% and some ventures

are assuring the returns of 31% . I find SIP is Productive way of saving

our money ., I invested in Large cap fund for long term because it’s a safe

fund for beginners. If we want high Profits we can go with Risk funds with

long-term.

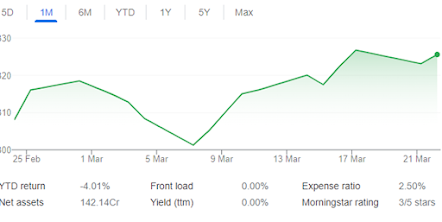

Figure 1 Leading AMC Growth chart

From the Above Graph itself we can understand what

share market is? Above graph shows the performance history of Leading AMC for

the last month., from the graph we can understand that price of shares are not

always linear , it may go up for two months and fall down for one month..,

Finally, we should have a will that all this settles good. Good thing in

share markets are they are much transparent and we know that whether our money

gets appreciated or depreciated. Problem with the conventional savings method

are they are less transparent.

In Conventional savings interest calculated during the returns is simple interest., This will bear us minimum profit and Compounding is the concept of the SIP and it will give us the expected returns at the end of the plan.

P.S : In this blog I am sharing the thoughts of the

SIP what I felt about it. This doesn’t mean you should choose SIP and invest

money in that. I am a very beginner of Investments and shares, so I am not in

the place of advising and recommending. Find a Reliable advisor and Start your

SIP Journey.

All the best!!!

Next blog is much awaited Our

home Garden-2, we added some interesting plants in our garden and this time

we tried to commercialize our Garden greens and we did it., With all these

details , get you back soon.

Our home Garden Part

1 : https://libinantony.blogspot.com/2022/02/gardening-its-that-time-ofyearwhen-lot.html

Great info bro....

ReplyDeleteVery informative and good presentation...more laurels to come on ur way....

ReplyDelete